Posts

People number provided you to definitely exceeds the newest sum number greeting to have Ca might need to be added to income for Ca aim. People distribution away from contributions more than the fresh Ca restrict could possibly get be nonexempt when delivered. To find out more, come across Schedule Ca (540) specific range guidelines in part We, Point C, range 20. For individuals who’lso are searching for a new savings account, believe if or not your’lso are best off looking for various other bank one to will pay far more interest as an alternative of one one to will pay you a bonus. As an example, one-date incentives are usually offered to your profile you to shell out minimal interest.

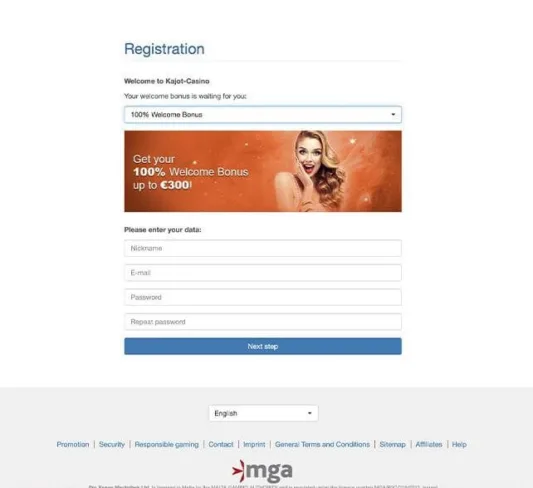

- You additionally get a deposit match all the way to $step 1,100, and therefore deal a good 20x wagering demands before it gets withdrawable dollars.

- But not called “free revolves,” offers away from sweepstakes casinos can be placed on any slot since the all the video game qualify.

- All Traders, as well as investors in the a supported region, need to post a clear and easy-to-see indication at the very least ten″x15″ after all social entrance to your agent’s bar or nightclub.

- However, qualifying for multiple incentives at the same time during the exact same bank always isn’t you can.

- Banks can get facilitate silver sales thanks to companion traders or ETF platforms.

Pupils, group exhausted away from Aloha High school because of claimed gas problem

Electronic costs can be produced using Internet Shell out on the FTB’s site, EFW as part of the e-document come back, otherwise their mastercard. Electronic Financing Withdrawal (EFW) – Build extension or estimated taxation costs using income tax thinking software. Check with your software supplier to choose when they help EFW for extension or projected income tax repayments. Enlisted tribal players just who found per capita income need reside in the associated tribe’s Indian nation to qualify for tax-exempt status.

U. Amended Return

The brand new budget indicates statutory change who does build rental schools eligible to possess investment in the Training Money Enhancement Money (ERAF). The new ERAF was made in the 1992 and you may redirects a share from assets taxation statewide away from urban centers, areas and you can unique districts in order to K-14 colleges. Rent colleges have been based the same 12 months while the ERAF, possesses not ever been explained if they are eligible for that it money. The newest finances proposes to lose $1.2 billion inside money agreed to various property applications inside the previous decades. Several famous decrease is $300 million from the Regional Early Step Believed Grant program, $250 million regarding the Multiple-Loved ones Property System, and you can $200 million regarding the Infill Infrastructure Give program.

Electronic Financial

- You will find the premier put match extra having Caesars as the really.

- Offers account are a great spot to arranged financing to own of several monetary needs.

- Make sure to has a fully funded crisis finance before you can believe a good Video game.

- You’re incapable of cash out people profits up to these criteria had been came across.

- The newest Governor recommends an installment of $331 million to invest the fresh yearly focus fee to your state’s Jobless Insurance coverage (UI) mortgage in the authorities.

RDPs processing because the hitched/RDP processing independently, previous RDPs processing unmarried, and you may RDPs having RDP modifications will use the fresh Ca RDP Changes Worksheet inside the FTB Club. 737, Tax Suggestions to have casinolead.ca published here Joined Domestic Partners, otherwise complete a federal specialist manera Setting 1040 otherwise 1040-SR. Import the total amount in the Ca RDP Adjustments Worksheet, line 27, line D, or government specialist manera Function 1040 or 1040-SR, range 11, to make 540, line 13. If you do not provides an enthusiastic SSN when you are a great nonresident otherwise citizen alien to have government income tax motives, and also the Irs (IRS) provided your an ITIN, go into the ITIN from the area to your SSN.

Once you click, visit otherwise label, you should establish your bank account (for those who wear’t currently have one at this financial institution) by giving their name, day out of delivery, target and other information that is personal. After you’ve logged inside otherwise proven their term, you can discover Video game you desire, unlock it and you will financing it, to date, the new Cd was lay and you’ll be great going. Research the lender’s character as a result of customers ratings, recommendations to your monetary other sites and reports out of regulating firms. So it protects your own deposits as much as $250,100000 for each depositor, per institution. In the event the a loan company’s prices are comparable otherwise beneath the federal mediocre, you could probably discover higher output someplace else.

The Things

For only $9.99, you’ll discovered step one.5 million Impress Gold coins and you can a totally free bonus from 31 Sweepstakes Gold coins (SCs). This is frequently coming in at $31 which is an excellent way for much more possibilities for cash awards. Generally, they arrive because the in initial deposit suits or fee bonuses.

For more information, come across Agenda California (540) certain line guidelines simply We, Section B, range 8z. Qualifying anyone and family instantly acquired GSS I and you may GSS II payments immediately after its 2020 tax returns try canned. You obtained the fresh percentage by using the choice you chosen to receive your income taxation refund.

Combine extent covered mind-functioning health insurance with other medical and you may dental costs (while the appropriate). The total amount of the health and you will dental costs is actually subject for the 7.5% of government AGI threshold. Enter the difference between the health and you will dental expenses deduction invited to possess California and you can government on the internet 4, line C. The brand new deductible NOL carryover below Ca rules differs from the brand new deductible NOL carryover under federal legislation. When you have a california NOL carryover away from prior years, go into the complete deductible Ca NOL carryover deduction to your most recent seasons of function FTB 3805V, Region III, line dos, column (f), since the an optimistic matter within the column B. Military group are the Ca Federal Guard, Condition Military Set-aside, or perhaps the Naval Militia.