Posts

Discover $three hundred, discover a great Flagstar In a position Checking account and then care for an average everyday balance out of $five hundred or higher to your earliest 3 months. To find that offer, open a SoFi Checking and you can Family savings and discover being qualified direct places totaling no less than $5,one hundred thousand. Your own extra amount will depend on the complete of one’s head dumps you receive regarding the 29-time research window. Chase Safe Banking will provide you with $one hundred when you unlock a merchant account and you may match the qualifying issues. Those actions are to over ten qualifying transactions within this 60 days from enrollment – the activities tend to be debit credit sales, online statement costs, Pursue QuickDepositSM, Zelle and you will ACH credit. Research the large Video game prices offered, that are typically offered by online banks and you can borrowing unions.

In such a case, you’ll discover written notice on the Irs demanding one to put taxation to your an alternative faith make up the newest U.S. That it publication explains your own income tax requirements as the a manager, along with farming employers and you may employers whose dominating place of business is within the Western Samoa, Guam, the fresh CNMI, the new USVI, otherwise Puerto Rico. They shows you the requirements to own withholding, transferring, revealing, using, and you will repairing employment taxation.

Essentially, you might’t https://lord-of-the-ocean-slot.com/win-big-on-lord-of-the-ocean-slot-heres-how/ eliminate insurance costs since the certified scientific expenditures to have Archer MSAs. You will see an excessive amount of efforts in case your efforts on the Archer MSA for the season are greater than the fresh constraints mentioned before. Excessive benefits created by your boss are part of their terrible income. If the a lot of share isn’t found in Setting W-2, field 1, you should declaration the other while the “Almost every other earnings” on your taxation go back.

Better high-give deals makes up about Oct 2025

Whenever we discover Mode 945 after the deadline, we are going to remove Form 945 as the recorded on time should your package which includes Mode 945 try safely handled, consists of adequate shipping, which can be postmarked by U.S. Postal Solution (USPS) on the or before the deadline, otherwise delivered by an Internal revenue service-appointed individual beginning service (PDS) to the or before the deadline. However, for many who wear’t follow these tips, we’re going to think Setting 945 recorded if it is actually received.

Point 4. Money by a professional Derivatives Dealer (QDD)

Distributions out of an enthusiastic Archer MSA which might be used to pay accredited medical costs aren’t taxed. Enter the sum of all of the numbers found in the box dos away from Setting 1042-S that are payments of U.S. resource FDAP money (and number claimed lower than both part step three and section cuatro). The quantity on the web 4 is always to equal the entire terrible quantity from You.S. origin FDAP money claimed on the internet 62c. The fresh quantity claimed on line 63d ought to be the numbers paid back by withholding representative from its individual money instead of thanks to withholding from the fee on the individual. The quantity on the web 63d is always to equivalent the sum of the all the number claimed inside the container 11 of the many Variations 1042-S provided for recipients. Withholding agencies should be fool around with given section cuatro reputation rules for the Forms 1042-S to possess repayments produced.

Would it be worth getting money for the a leading-give checking account?

Certainly Bucks App’s most significant brings would be the fact savers can also be secure as much as step 3.75% APY, money to your par with of the best large-produce savings membership. To open one higher APY, whether or not, you’re going to have to establish a month-to-month lead put away from from the minimum $300. Payments are increasingly being sent now and ought to get to “many cases” from the later January 2025, depending on the Internal revenue service. Costs might possibly be instantly transferred by using the financial suggestions listed on the brand new taxpayer’s 2023 taxation return otherwise delivered by the paper view. Eligible taxpayers might also want to discover an alternative page alerting her or him out of the brand new percentage.Want to make more money outside of the day job?

The brand new now offers that seem on this web site are from businesses that compensate all of us. But which payment cannot influence all the information we publish, or even the analysis that you come across on this site. We really do not include the world away from businesses or financial now offers which are available to choose from. You can add or replace your head put suggestions to have Va handicap compensation, your retirement benefits, or degree benefits on line. As a general rule, the greater amount of you can save to own a deposit, the better – you’ll be able to owe quicker, rating less rate of interest, has less month-to-month costs and you will a much better threat of delivering acknowledged because of the lenders.

Best bank extra for business examining

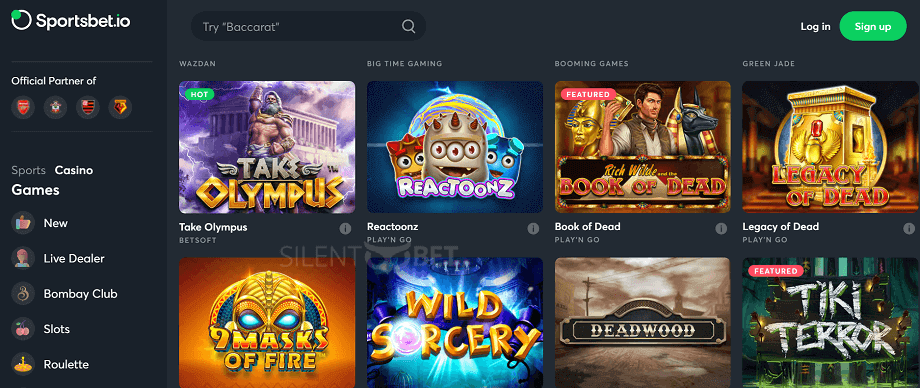

Their “buckets” feature can help you save for specific sales otherwise means. Totally free spins can be used from the individuals to try the new casinos without having to chance real cash, and you will $1 is virtually 100 percent free. The brand new 100 percent free revolves can be used for rotating reels to your an excellent particular video game, according to the local casino’s strategy. After you have used up each of 100 percent free revolves, you could withdraw them once fulfilling the newest betting standards. Finder You are a development service which allows one compare some other services business.

It part has got the regulations you to businesses need realize when they want to make HSAs open to their staff. You can’t get rid of insurance fees because the qualified scientific costs until the newest advanced is actually for of the following the. Numbers provided to your year tend to be benefits on your part, your employer, and any other individual. However they is one accredited HSA money shipping made to your HSA.